Welcome To 2024 Tax Update

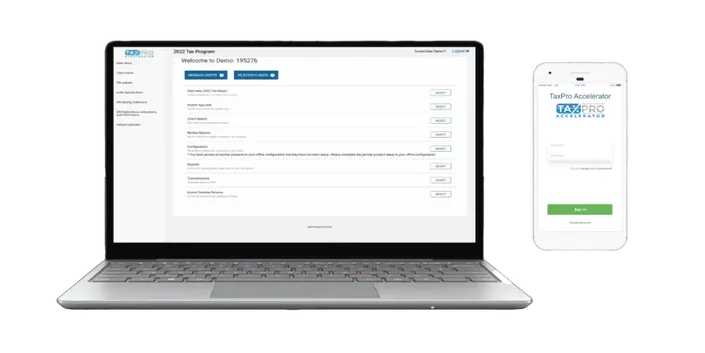

Welcome to the 2024 Tax Update course! In this vital session, we'll delve into the latest updates and changes in tax laws and regulations, with a special emphasis on Due Diligence requirements. This area has become a focal point in recent IRS audits, making it more important than ever for tax professionals to stay informed and compliant. We'll guide you through the newest requirements and best practices to ensure that you're fully prepared for this shift in focus.

Our discussion will not only cover the theoretical aspects but also practical applications, providing you with actionable strategies to enhance your due diligence processes. With the IRS intensifying their scrutiny in this area, it's crucial to understand the nuances and implications of these changes. By the end of this course, you'll be equipped with the knowledge and tools necessary to navigate these updates confidently and maintain the highest standards in your tax preparation practices.

Our Curriculum Is Constantly Updated!

- Due Diligence - Lucy's Class (71:39)

- Due Diligence - Residency Requirement - Part 8 - IRS EITC (3:44)

- Due Diligence - Schedule C Recordkeeping - 1 - IRS EITC (6:41)

- Due Diligence - Tie Breaker Rule - Part 11 - IRS EITC (3:37)

- Due Dilligence - AGI Tie Breaker Rule - Part 6 - IRS EITC (3:16)

- Due Dilligence - Audit - Part 5 - IRS EITC (5:34)

- Due Dilligence - Disabled Child - Part 7 - IRS EITC (4:36)

- Due Dilligence - Employer Responsibility - Part 2 - IRS EITC (5:10)

- Due Dilligence - Qualifying Child - 1 - Part 3 -IRS EITC (5:08)

- Due Dilligence - Qualifying Child - 2 -Part 10 - IRS EITC (4:01)

- Due Dilligence - Schedule C Recordkeeping - 2 - Part 9 - IRS EITC (4:47)